Abstract

The availability of capital resources for companies is essential to promote investment, job creation, and economic growth. In the financial environment, it is common to find the banking system and the debt market as sources of resources. However, the level of financial education combined with the size and depth of the stock market in any nation conditions companies’ access to alternative sources of financing with differentiated financial costs. In this sense, the article aims to contribute to understanding the Mexican debt market, explaining how it works, its main characteristics, and providing information on two instruments used to raise capital: obligations and certificates.

The text is divided into three sections: the first is dedicated to the importance of financial markets and financing for companies; the second deals with the corporate financing options available in Mexico; the third describes in-depth the characteristics of the securities known as obligations and tradable certificates, based on the applicable regulations; and finally, the fourth section is dedicated to explaining the functioning and types of certificates that can be placed.

Introduction

Companies prefer sources of financing with lower financial costs, as well as simple ways of operating and obtaining them. For this reason, suppliers are the main source of business financing used in Mexico; on the other hand, debt securities are in last place, as evidenced by the data issued by CNBV (National Banking and Securities Commission), the issuance of domestic debt, and fiduciary bonds and certificates grew 4.7% per annum in real terms in June 2021 and reached 46.0% of GDP, of which the Federal Government continues to be the main issuer of fixed-income securities, with a balance equivalent to 28.4% of GDP (CNBV, 2021, p.13).

This is due to such preferences, together with the impossibility for micro, small and medium-sized companies to access the securities market.

From this information, a question arises: Why is it so difficult for Mexican companies to place debt in the stock market? The answer is that most of them do not comply with the requirements requested by the market, such as the amount of capital, corporate governance structure, issuance of audited financial statements; this, together with a lack of financial knowledge, results in the assumption of several fallacies such as «it is better not to get into debt» and «debt is bad».

In this order of ideas, we are convinced that the combination of knowledge and organization generate environments that make it feasible to obtain positive results. We intend to contribute to knowledge with this article whose purpose is to improve the understanding of the corporate financing options available in the Mexican financial environment, describing their characteristics and explaining their operation with emphasis on the instruments known as obligations, tradable certificates that provide long-term financing. This will contribute to financial education and will stimulate investment by nationals and foreigners in the debt market.

We will also discuss the advantages of using the debt securities market, such as the possibility of financing for longer terms, attracting economic resources whose destination is the business activity; obtaining capital with financial costs, and advantageous financing conditions, concerning those offered by the banking system. And, of course, its economic importance, the bond market is vital for economic activity because it is the market where interest rates are determined. Interest rates are important on a personal level because they guide our decisions to save and to finance major purchases (such as houses, cars, and appliances, to give a few examples). From a macroeconomic standpoint, interest rates have an impact on consumer spending and business investment (Federal Reserve Bank of San Francisco, 2005).

The Mexican securities market is one of the largest in Latin America; however, the placement of new issues is infrequent. Companies prefer short-term debt over instruments such as debentures and stock certificates. In addition, there is little investor awareness of these types of corporate debt products. Our interest is to approach the subject using a descriptive-analytical technique

Financial markets and corporate finance: Relevance and impact.

For the development of our research, we have conducted a broad review of the financial literature focused on the relevance and impacts of corporate finance, with a particular focus on the Mexican case.

The importance of financial markets and systems is based on their concept, how they are formed, and their functions. For Díaz and Vázquez (2016, p. 35), the financial system is constituted by the set of markets, institutions, and legal mechanisms, whose main objective is to efficiently channel the savings generated by economic units with surpluses towards those with deficits. On the other hand, the financial market is any physical or virtual place or mechanism that allows the supply and demand of financial assets.

In this sense, both the financial system and the development of financial markets are fundamental for any country as mechanisms for the transfer of resources whose final purposes can be their application in consumption or investment, both of which are underpinnings of economic growth that make it possible to generate income and products for society. In this regard, Shiller (2012, p. 10) argues that finance remains a social institution, essential and necessary for managing risks that enable society to transform creative impulses into vital products and services; finance with all its flaws and excesses is a force that has the power to help us create a more prosperous and equitable society because finance has been central to the thriving market economies of the modern era.

In terms of financial development, understood as a historical process consisting of changes in financial systems, which permeate the social relations of economic agents, establishing a structure and functions in these. Financial development is a consequence of the application of economic and financial policies that establish the rules of the game for intermediaries and economic agents; providing incentives or generating restrictions which in turn enlarges or attenuates: the flow of available resources, the levels of risk. (Vázquez, 2018, p. 14). This subject has been deeply studied, among the seminal works find Gerschenkron (1962, p. 54) argued that a well-developed banking system was a prerequisite to mobilize capital for a successful project of industrialization and more recent research finds the finance-industry link acquires great practical significance in the quest for understanding the nature and causes of industrial development and in pinning down crucial lessons for policymaking (Kothakapa; Bhupatiraju; Sirohi1, 2020, p. 216).

By combining the definitions presented, it is possible to affirm that financial markets are relevant for the availability and distribution of resources that can be used to generate physical investment, which in turn allows companies to be created or to increase their productive capacity, thereby providing more jobs and obtaining higher levels of national income. However, not only the existence of financial markets is required, but also their development, i.e., larger size, which translates into more options for financial products and services for investment and financing. More companies placing their securities in the market and more people are interested in being market bidders and takers. All this in an environment of stability and sustained growth.

The need to develop and increase the size of financial markets in countries considered emerging and even poor, including Latin America, is a concern and a recurrent motive for debate among international financial and research organizations. For example, Manuelito and Jiménez (2010, p.10) point out that the rate of investment in the Latin American region has historically been lower than in other structurally similar regions such as Asia, and that the expansion of investment has depended on obtaining external financing, which is conditional on the possibility of accessing international financial markets.

In brief, a broad, competitive financial structure is crucial to provide available sources of finance for all types of enterprises, whether start-up or long-established, because it drives their long-term sustained growth and, consequently, the growth of countries.

Corporate finance in Mexico

Using economic and quantitative analysis, we present the segmentation by type of issuer in the Mexican debt market. We decided to describe the obligations and participation certificates due to their condition as long-term debt instruments. Also, for being one of the last sources of financing that companies use in their financial structure.

During the COVID-19 pandemic there were two clear spectrums within Mexican companies, on the one hand, the micro, small and medium-sized ones that significantly reduced their operations and their income fell significantly. On the other hand, the large companies that accelerated their production and sales, a fact that led them to require fresh resources that would allow them to support them financially, as we will see, the certificates of participation between 2019 and 2020 rose exponentially, this being a of the main reasons.

The stock market, by its very definition, is a place where an infinite number of investors attend, to accommodate their financial surpluses. Naturally, this is done after studying the best alternatives to satisfy their investment needs, since investors consider the following: risk, yield, and liquidity offered by the type of instrument (Bojorquez, 1994, p. 94)

In the Mexican market, companies have the option of issuing and placing debt through various instruments regulated by the General Law of Credit Instruments and Operations. This law explains the characteristics and operation of various instruments known as debt instruments. For this article, we will focus on obligations, tradable certificates.

From the investor’s point of view, debt securities grant ownership of a right to repayment of the amount invested (nominal value) and of any interest payments (coupons). There is a promise of repayment of both the principal and the coupon, which occurs at the end of the instrument’s term. On the maturity date, the instrument is fully redeemed and ceases to circulate in the market.

When debt securities have maturities longer than one year, they are considered long-term and are usually assigned the generic name of bonds. In addition, an adjective is added to their name about their issuer: if they are issued by non-financial firms then they are known as corporate bonds; if they are issued by banks, then they are considered bank bonds; and if the government is their issuer, they are called government bonds.

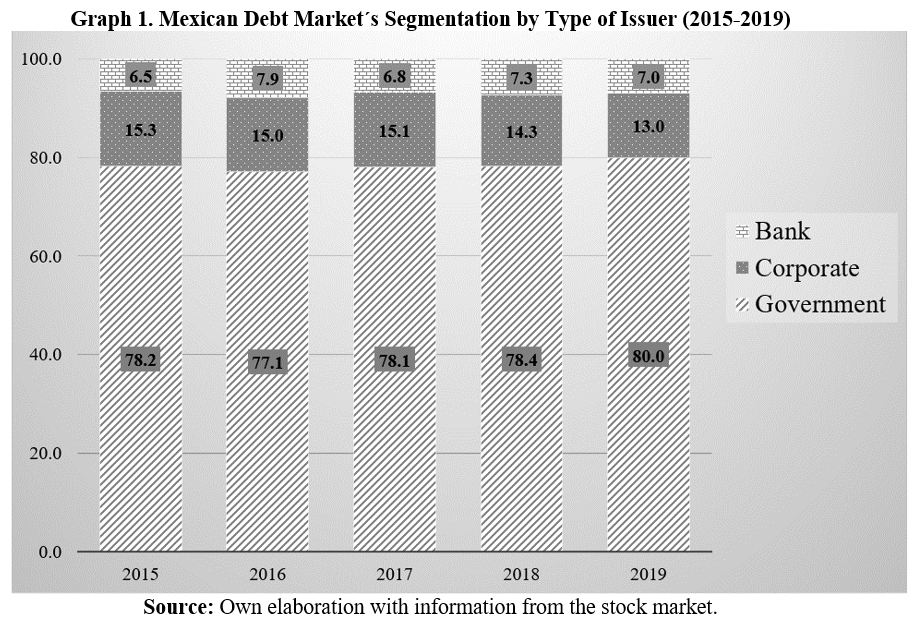

By type of issuer, the largest market is the government market, comprising on average eighty percent of the issuance, followed by non-financial company (corporate) issuance with around 15% and finally, bank issuance between six and seven percent of total issuance, as shown in Graph 1, which shows the composition of the market over the last five years.

In Mexico, since 1990, the expansion of financial capital has been allowed, which in the traditional economic perspective represents the union between productive and financial capital. In this way, production or commercial companies and banking institutions can be owned by the same investor or a group of investors. In this way, the financing of the companies is guaranteed in principle by the banking institutions of the same group. Therefore, both banks and companies need to go to the stock market either to issue shares or debt securities, both short and long term. The latter, as can be seen in the graph, are preferred by both multiple banking institutions and corporate groups.

In addition to this, the strength of financial capital has allowed the exponential growth of equity certificates before and during the pandemic, in corporate finance, thus strengthening their financial structures, particularly in the area of liabilities, taking advantage, among other aspects, of the low level of interest rates.

Reviewing the number of issues made in the last five years and the types of instruments placed in the Mexican securities market, we find that obligations have been on the decline, while tradable certificates are the most common instrument issued by both government and corporate issuers, as shown in table 1, number of issues by instrument.

The banking system in the country is highly concentrated, mainly featuring six multiple banking institutions: BBVA, Santander, Citibanamex, Banorte, HSBC, Scotiabank.

Six of them are global banks controlled by foreign capital, although technically they have been constituted as Mexican branches due to the regulation that prevents foreign commercial companies from being constituted on the matter. Only one is completely controlled by Mexican capital, it is Grupo Banorte.

Although there are more than fifty-five commercial banks, many are foreign and focus on offering financial services to investors who carry out operations in the stock market.

The banks of Mexican origin outside Banorte are very small and with little capacity to carry out important debt issues, in this sense, it is easy to see that the issuance of certificates fell into an abyss when going from 70 issues to only 3 before of the pandemic. However, due to the health crisis that hit the world and affected the finances of banking institutions, they had to make use of them, which allowed them to be increased to 17, which is far from the number they had in 2015.

The possibility of issuing obligations by Mexican companies has existed since the last quarter of the twentieth century, although it has not been widely accepted, as shown in Table 1. On the other hand, the tradable certificates that have been authorized since this millennium have had exponential growth. Why? What are their characteristics? and why are they preferred?

Obligations and their characteristics

These types of marketable securities called obligations are long-term debt securities issued only by public limited companies, which is why they are classified as private or corporate financial instruments. They play an important role within the domestic financial system, both as a source of liquidity for the banking sector and as a pricing benchmark for a wide range of contractual obligations (Wilson y Boge, 2011, p. 39)

For investors, they represent the individual participation as a holder in a collective credit constituted at the expense of the issuer. They may be secured by pledges or mortgages but are usually backed only by the economic and financial health of the issuing company.

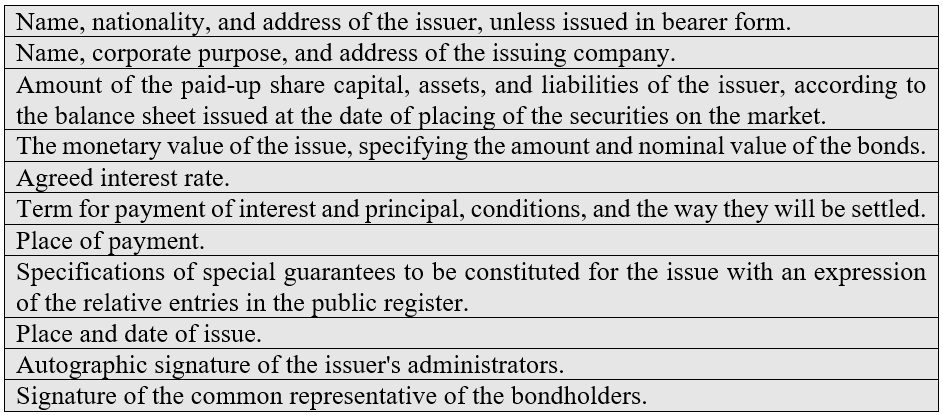

In the global financial market, their similar product is coupon corporate bonds, issued at a face value of 100 currency units and multiples thereof. In the case of the Mexican market, their circulation requires their registration in the National Securities Registry, and they can also be placed abroad. Bonds issued under Mexican regulation must contain the following information:

A company may not issue bonds for an amount exceeding the net assets shown in its balance sheet unless the issue is made for the value or price of the assets to be contracted or acquired by the issuer.

The issuer may not reduce its share capital except in proportion to the repayment it makes on the issued bonds, nor may it change its corporate purpose, registered office, or name without the consent of the general meeting of bondholders.

When issuing these instruments, companies are obliged to publicly present a balance sheet certified by a public accountant and must do so via an electronic system established by the Ministry of Finance and Public Credit, the body in charge of financial policy in Mexico.

The bondholder must collect the coupons or interest due within a maximum period of three years, otherwise, he/she will lose this right. For the collection of the principal, the term is five years from the maturity date stipulated for settlement.

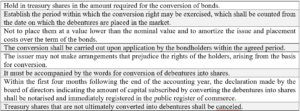

These instruments can be issued with the possibility of conversion into shares, in which case they are called convertible bonds. This is a bond in which the holder will receive interest for a specified period, with the additional feature of granting the right to exchange it for shares of the issuer, in a predetermined proportion and conversion period. In this sense, the investor starts as a creditor of the issuer and ends up as a shareholder.

The issuer of convertible bonds is subject to the following requirements:

There are also collateralized debt obligations (CDOs), financial instruments that make it possible to restructure portfolios with debt securities and redistribute credit risk. For this purpose, the portfolio is segmented into different segments according to collection rights. The holders of the last tranche can collect until the end, so they are the first to absorb potential losses and their risk is higher, but their yield may be higher too.

A collateralized debt obligation is an asset-backed security whose underlying collateral is typically a portfolio of (corporate or sovereign) bonds or bank loans. A CDO cash flow structure allocates interest income and principal repayments from a collateral pool of different debt instruments to a prioritized collection of CDO securities, which we call “tranches” (Duffie and Garleanu, 2001, p.41)

CDOs function as insurance by covering losses that exceed a certain percentage of the nominal value of a portfolio. In this sense, it offers benefits to both conservative investors who would participate in the first tranche and those with an aggressive profile who would participate in the last tranche.

Since its inception in the mid-1990s, the market for CDOs has become one of the most rapidly growing financial markets ever. Industry sources estimate the size of the CDO market at the end of 2006 to be nearly $2 trillion, representing more than a 30 percent increase over the prior year (Longstaff and Rajan, 2008, p. 529), and Global bond markets outstanding value increased by 16.5% to $123.5 trillion in 2020, while global long-term bond issuance increased by 19.9% to $27.3 trillion (SFMA, 2020; p. 63).

The process for placing debentures and CDOs is often complicated and unattractive for companies given the high-interest rate they must pay.

Certificates of participation

Participation certificates are debt securities issued by a trusted company that represents the right to an aliquot part of the fruits or yields of the securities, rights, or assets that the issuing company holds in an irrevocable trust for that purpose, the right to an aliquot part of the right of ownership or title to such assets, rights or securities, or the right to an aliquot part of the net proceeds resulting from the sale thereof. The purpose of these securities is to facilitate investment in property of all kinds, movable and immovable, securities, rights, shares of companies, industrial or commercial enterprises, through the acquisition of them by multiple interested parties who, with small amounts, may participate in important investments; the investment may be increased by the acquisition of other certificates of the same issue or by making partial payments to complete the nominal value of a certificate (Calvo and Flores, 2003, p. 231).

These debt securities represent one of the following three cases:

a) The right to an aliquot share of the fruits or yields of securities, rights, or property of any kind held in an irrevocable trust for that purpose by the trust company issuing them.

b) The right to an aliquot share of ownership or title to such property, rights, or securities.

c) The right to an aliquot share of the net proceeds from the sale of such property, rights, or securities.

In cases, b and c, the entitlement of certificate holders in each issue shall be equal to the percentage that the total nominal value at the time of issue represents about the market value of the assets, rights, or securities, as determined by an expert valuer.

If, on the sale of such assets, rights or securities, their market value has decreased, without being less than the nominal amount of the issue, the allotment or cash settlement shall be made to the holders up to a value equal to the nominal amount on their certificates; if the market value of the total amount held in trust is less than the nominal amount of the issue, they shall be entitled to the full application of the assets or net proceeds from the sale thereof.

The certificates are issued in denominations of 100 currency units and multiples thereof, with coupons and in series, which shall give equal rights to their holders, failing which the holder may request the nullity of the issue.

The certificate may or may not be redeemable. Redeemable certificates entitle their holders, in addition to the right to an aliquot part of the corresponding fruits or yields, to reimbursement of the nominal value of the securities. In the case of non-redeemable securities, the issuer is not obliged to repay the nominal value. Upon termination of the trust, which is the basis for the issue and by the resolutions of the general meeting of the certificate holders, the trust assets shall be awarded and sold, and the net proceeds of the sale shall be distributed.

The nominal amount that can be issued in the form of participation certificates must be determined by an appraisal carried out by a development bank, whose legal name in Mexico is the national credit society based on the appraisal it carries out on the trust assets. To formulate the opinion and fix the nominal amount of an issue, the commercial value of the assets will be taken as a basis, and in the case of redeemable certificates, a prudent margin of security for the investment of the corresponding holders will be estimated on this basis.

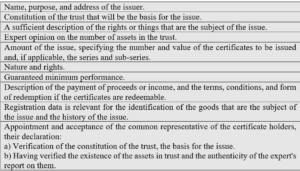

Before issuing certificates, a unilateral declaration of intent by the issuer must be made in a public deed stating the following:

There are various categories of this type of security, such as housing certificates, instruments that represent the right, upon payment of the full number of dues, to the transfer of ownership of a dwelling, enjoying in the meantime the direct use of the property; and in case of default or abandonment, to recover a part of these installments by the redemption values to be fixed.

Only banks that are authorized to carry out fiduciary operations may issue this type of certificate. The certificates issued must show the shares of the various co-owners in assets, securities, or securities held by them. For the issuance of participation certificates, trusts may be set up by all kinds of companies. These certificates must contain the following information:

A common representative shall be appointed to represent all the certificate holders, who may or may not be a certificate holder. The office of a common representative is personal and shall be held by the individual appointed for this purpose or by the ordinary representatives of the credit institution or of the financial or trust company appointed for this purpose. The common representative may grant powers of attorney.

In the case of real estate participation certificates (CPI), the issuer may establish, for the benefit of the holders, rights of direct use of the trust property, the extent, scope, and modalities of which shall be determined in the corresponding issuance act. The nominal amount of an issue of participation certificates will be determined by an opinion issued by a Mexican development bank based on an expert opinion.

On the demand side, investors are usually attracted to new instruments, especially when they expect to obtain high yields and maturities in the short term.

One of the main attractions of participation certificates is their convertibility into equity securities; therefore, if there are no favorable expectations regarding the yields of debt instruments, they can be exchanged for equity securities, in which a dividend or profit per share will be obtained. This is the fundamental reason why in Table 1, in the period 2018 to 2019 there was a growth of more than one hundred percent of certificate issuances.

Conclusions

Any economy needs to have financing channels that allow companies to obtain the necessary resources to invest and grow in the medium and long term, but it is also important for market participants and businessmen to be aware of the available options, their characteristics, and operating mechanisms.

Empirical evidence from the Mexican market shows that the debt market is substantially based on government issues and that opting for debt issues is used marginally, about the sources of financing used by Mexican companies, 67. 4% of the companies surveyed indicated that they used financing from suppliers, 36.1% used credit from commercial banks, 15.8% indicated having used financing from other companies of the corporate group and/or the head office, 4.5% from development banks, 3.9% from banks domiciled abroad, and 1.0% from debt issuance (Banco de México, 2021, p. 3).

We believe that counteracting this trend requires raising awareness of other corporate financing options such as obligations and certificates; therefore, in this paper we will focus on explaining their characteristics and operation, contributing to financial education that will ultimately benefit companies by informing them that they have greater alternatives and that they will be interested in turning to the securities market.

The development of the domestic government securities market has had great benefits, among which the following stand out: i) it provides more financing alternatives for both the government and the private sector, reflected in longer terms and lower financing costs; ii) it fosters a much deeper investor base with different interests and investment horizons, thus promoting the secondary securities market (Banco de México, 2018, p. 75).

The existence of two stock exchanges (Bolsa Mexicana de Valores and the Bolsa Institucional de Valores) has fundamentally promoted the placement of debt by large Mexican companies, so there is no growth in the equity market. In this sense, corporations have benefited from the benefits offered by the placement of stock certificates and from the different modalities in which they can operate.

However, in neither of the two exchanges is there a small business section that encourages the incorporation of micro and small businesses and naturally makes it impossible for them to issue bonds, certificates or any other debt title. Therefore, it is unlikely that there will be a growth of the companies listed on the stock exchange and only those that are already trading their equity securities or short and long-term debt, are the only ones that will continue to benefit from the benefits of the issuance of liabilities, particularly stock or participation certificates or any other similar scheme.

Acknowledgments:

This article is part of the advances in the projects PAPIIT No. IA302221 Financial Inclusion in Mexico and PAPIME No. 303021 Elaboration of didactic material for the study of economic and financial indicators, both financed by the General Department for Academic Staff Affairs (DGAPA by its Spanish acronym) of the National Autonomous University of Mexico (UNAM).

References

Bank of Mexico (2018) “Evolution of Corporate Financing during the January- March Quarter”, Press Release, Mexico.

Bank of Mexico (2018) Circular 16/2018 addressed to credit institutions and the FND, regarding amendments to circular 3/2012 (subordinated debentures). Official Journal of the Federation, Secondary Regulations, (November 14th). Mexico. Retrieved from: https://www.banxico.org.mx/marco-normativo/normativa-emitida-por-el-banco-de-mexico/circular-3-2012/%7BE1A161B0-BC22-69F2-E1CE-7DA5C1EAF078%7D.pdf

Bank of Mexico (2021) “Developments in corporate financing during the quarter October – December 2020. The main results of the quarterly survey to assess the credit market situation.” Press release, (February 18th). Mexico. Retrieved from: https://www.banxico.org.mx/publicaciones-y-prensa/evolucion-trimestral-del-financiamiento-a-las-empr/%7B02B30FD9-128B-0A1D-799E-46163C0DD35A%7D.pdf

Bank of Mexico (2021) “Evolution of Corporate Financing during the July-September Quarter”, Press Release, Mexico.

Bojorquez, C. (1994) The Stock Market: An Option for Local Public Financing. INDETEC. Mexico.

Calvo, O. and Flores A. (2003) “Obligaciones.” Revista Derecho Mercantil. Banking and Commerce, Mexico, 230-236.

CNBV (National Banking and Securities Commission) (2021) Ahorro Financiero y Financiamiento en México, Economic Research Series, General Directorate of Economic Studies, Mexico, June. Retrieved from: https://www.gob.mx/cms/uploads/attachment/file/680189/AFyFeM_JUN_2021_vf.pdf

Díaz, M. (2004) Invierta con Éxito en la Bolsa y Otros Mercados Financieros. Mexico: Gasca – Sicco Publishing House.

Díaz, M. (2017) Portafolios de Inversión. Mexico: Trillas Publishing House.

Díaz, M. and Vázquez, N. (2014) Mercados Financieros Internacionales. Mexico: Trillas Publishing House.

Díaz, M. and Vázquez, N. (2021) Sistema Financiero Mexicano. Mexico: Trillas Publishing House.

Duffie, D. and Garleanu, N. (2001) “Risk and Valuation of Collateralized Debt Obligations”, Financial Analysts Journal, 57:1, January/February, 41-59. DOI: 10.2469/faj.v57.n1.2418.

Executive Branch (2018) General Law on Debt Instruments and Credit Operations. Official Journal of the Federation, (June 22nd), Decree issued by the Mexican Government. Retrieved from: http://www.diputados.gob.mx/LeyesBiblio/pdf/145_220618.pdf

Federal Reserve Bank of San Francisco (2005) What are the differences between debt and equity markets? Dr. Econ Publications. USA.

Gerschenkron, A. (1962) Economic Backwardness in Historical Perspective. Harvard University Press, Cambridge.

Glen, A. (2015) Knowing financial markets. Mexico: Trillas Publishing House.

Graham, J. Scott, B. and Megginson, W. (2011). Corporate finance: the link between theory and what companies do. Mexico: Cengage Publishing House.

Kothakapa, G., Bhupatiraju, S., Sirohi, R. (2021) Revisiting the link between financial development and industrialization: evidence from low and middle-income countries. Ann Finance 17, 215–230. DOI: https://doi.org/10.1007/s10436-020-00376-y

Longstaff, F. and Rajan, A. (2008) “An empirical analysis of the pricing of collateralized debt obligations” The Journal of Finance Vol. 63, No. 2, April, p. 529-563. Retrieved from: https://www.jstor.org/stable/25094450

Manuelito, S. and Jiménez, L. (2010) “Financial markets in Latin America and investment financing: stylized facts and proposals for a development strategy.” Economic Commission for Latin America and the Caribbean, Development Macroeconomics Series, No. 107, (November) Chile: 1-57. Retrieved from: https://repositorio.cepal.org/bitstream/handle/11362/5337/1/lcl3270.pdf

Shiller, R. (2012) Finance in a just society. Spain: Deusto Publishing House.

SIFMA (2021) Capital markets factbook, Global Financial Markets Association, USA. Retrieved from: https://www.sifma.org/wp-content/uploads/2021/07/CM-Fact-Book-2021-SIFMA.pdf

Vázquez, N. (2018) Desarrollo Financiero y Crecimiento Económico: estudio comparative de México y Chile 1990 a 2014. Germany: EAE Publishing House.

Willson y Boge (2011) Bulletin, Quarter September, Central Bank of Australia, 39-49.